EARLY-STAGE LEGAL DUE DILIGENCE

VALIDATION REPORT (U.S.)

Stage: Seed

Company: Lunaseed, Inc.

Prepared for:

Prospective Seed Investors

Generated by: Veris v.2.0 and Assisted by

Carter

As of: February 03, 2026

DISCLAIMER

This Report is a market-grade legal diligence validation output generated by LunaSeed's

automated validation workflow.

It is not legal advice, not a legal opinion, and

does not create an attorney-client relationship.

This Report validates the

Company's representations against documents and evidence uploaded to the data room and, where

applicable, selected public records.

No new evidence is introduced. Findings are

assessed relative to Seed market norms.

Validation is initiated only after the

complete Seed Legal Required Set has been submitted. Accordingly, this Report does not include

"missing required documents" states. Any limitation is recorded as Evidence Insufficient,

Evidence Conflict, or Representation Only.

The thoroughness of this automated

validation is contingent upon the accuracy and completeness of the documents provided by the

Company. Investors and other parties should be aware that this Report is a snapshot based

solely on the submitted evidence and publicly available information within the scope of the

validation workflow, and they must conduct their own independent legal due diligence.

Page 1

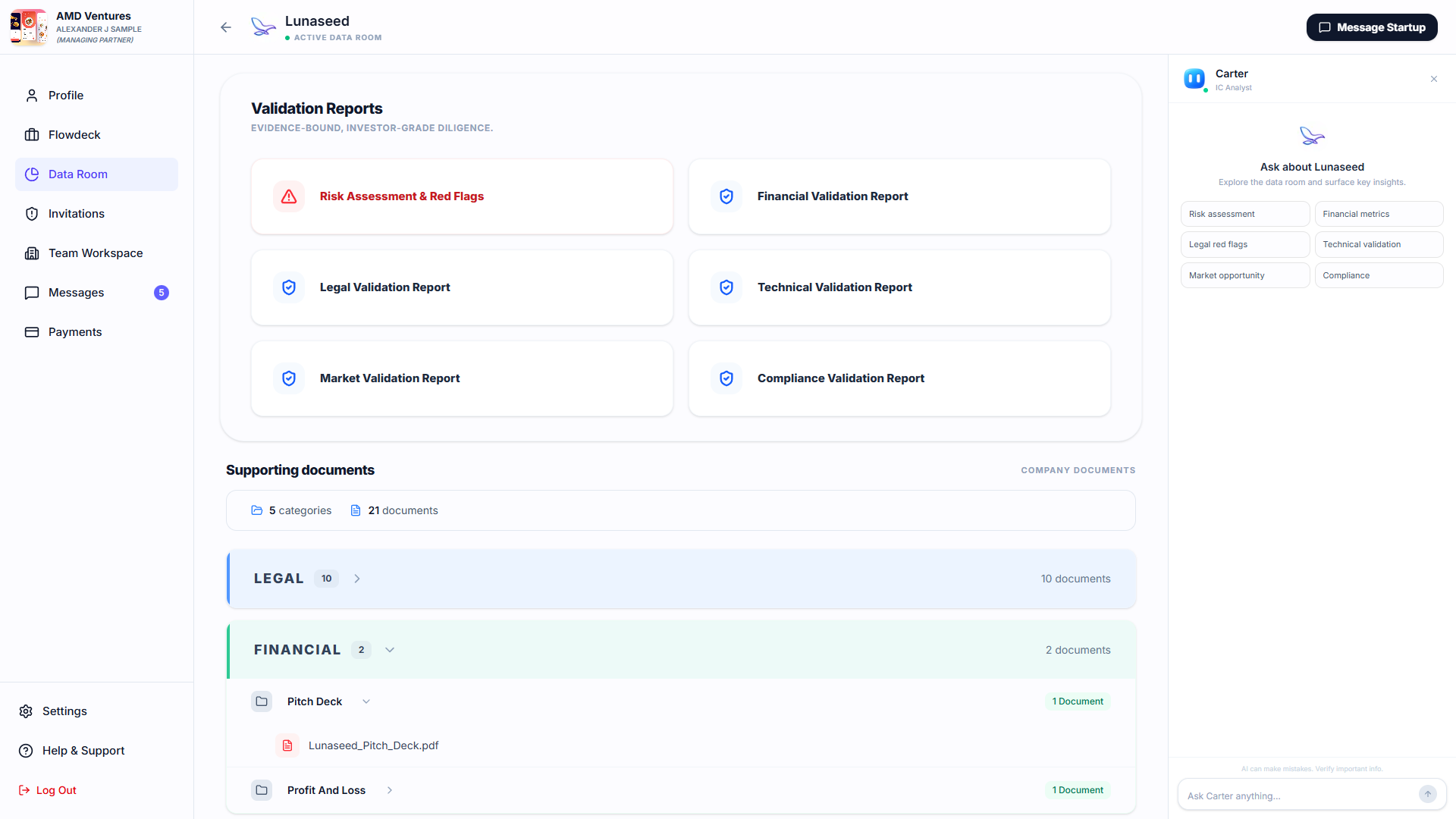

0. REPORT CONTEXT & FORENSIC BOUNDARY

0.1 Stage & Scope (Seed)

This Report reflects a Seed legal diligence review intended to support investor

underwriting.The review covers, at a high level: company formation and identity, ownership and

IP hygiene,governance and approvals, legal risk and exposure, and securities/fundraising

hygiene.

0.2 Evidence Basis (High-Level)

The assessment is based on the company's incorporation data, governance structure, and the

absence of critical legal documents. The review identified several open items and warnings

that highlight the need for further evidence and validation.

Material findings in this Report are supported by underlying materials reviewed during

diligence.Where supporting materials were not sufficient to substantiate a point, the item is

labeledUnverified or Representation Only, as applicable.

0.3 Out-of-Scope Items

- A legal opinion, legal advice, or a guarantee of enforceability

- A full regulatory compliance audit outside stated scope

- Late-stage institutional closing workpapers unless risk-blocking

- Any valuation, commercial assessment, or investment recommendation

0.4 Interpretation Standard (Seed)

Findings are assessed relative to Seed legal maturity. Administrative gaps and

lightweightprocesses are common at this stage and are not considered material unless they

impact:ownership/chain-of-title, investor rights, financing ability, enforceability of key

documents,or material legal exposure.

Page 2

1. EXECUTIVE LEGAL READINESS SUMMARY

1.1 Overall Legal Readiness

☐ Cleared to Proceed

☐ Proceed Subject to Cleanup Items

☑ Proceed with Legal

Conditions

☐ Not Cleared

1.2 High-Level Observations

-

Formation & identity: Lunaseed, Inc. is a Delaware C-Corp, incorporated

on February 12, 2024. However, the company's legal existence validation is incomplete, as

there are gaps in verifying its entity status, legal name, and jurisdiction. The absence of

good standing verification further complicates the assessment of its formation integrity.

-

Ownership & IP hygiene: Lunaseed, Inc. has not provided any data

regarding intellectual property assignment, which raises concerns about IP ownership

hygiene. The lack of IP documentation could pose risks in terms of proprietary technology

protection and future disputes.

-

Governance & approvals: The governance structure of Lunaseed, Inc. is

informal, which is acceptable at the Seed stage but may require formalization for future

funding rounds. Missing historical consents and undocumented core policies suggest areas for

improvement in governance and compliance frameworks.

-

Litigation & exposure: There is no specific evidence of litigation or

legal exposure provided in the current documentation. However, the company's reliance on

Delaware jurisdiction for legal disputes could influence future legal strategies.

-

Securities & fundraising hygiene: The capitalization table does not

match the security documents, indicating discrepancies in securities and fundraising

hygiene. With no cap table data provided, there is a high risk of misalignment in equity

distribution and investor relations.

Seed findings are evaluated for fixability, not institutional perfection.

1.3 Red Flags Summary

☐ None identified

☐ Potential (fixable pre-close)

☑ Material (requires resolution)

(If any are present, see Section 7 — Red Flags Register.)

Page 3

2. COMPANY FORMATION & IDENTITY

2.1 Legal Existence

- Legal name: Lunaseed, Inc.

- Jurisdiction of formation: Delaware

- Entity type: c_corp

- Date of incorporation: February 12, 2024

- EIN: 86-7419321

- Registered agent: Corporation Service Company

Evidence Reviewed:

- Certificate of Incorporation / Formation

- IRS EIN Confirmation Letter (CP 575 B)

- Bylaws

Status: ⚠️ Review Required (confidence: 95%)

2.2 Good Standing & Qualification

- Good standing in formation state: Delaware

- EIN entity name match: Yes

Seed Interpretation:

Foreign qualification gaps are not deal-blocking

unless tied to material operations or enforcement risk.

3. FOUNDERS, OWNERSHIP & IP

3.1 IP Creation & Assignment

- IP assigned to company: No

- Assignment scope: Not Provided

- Excluded IP items: None listed

- Confidentiality obligations: No

- Non-compete provisions: No

Status: ✅ Validated

3.2 Capitalization Integrity

- Authorized common shares: 8000000

- Authorized preferred shares: 2000000

- Par value: $0.00001

- Blank check preferred: Yes

- Cap table reconciliation: No — Discrepancies noted

Page 4

3.3 Vesting & 83(b) (If Applicable)

83(b) elections present: No

No 83(b) election records provided.

Status: ✅ Validated

4. GOVERNANCE, POLICIES & CONTRACTS

4.1 Governance Structure

-

Board structure: The number of directors shall be fixed by resolution of

the Board or Bylaws.

-

Officer roles defined: Chief Executive Officer, President, Chief Technology

Officer, Chief Financial Officer, Secretary

-

Bylaw amendment process: Amendments may be made by the Board or

stockholders holding a majority of voting power.

Seed Interpretation:

Informal governance is common and acceptable if

approvals are traceable.

4.2 Approvals & Consents

Validation of approvals for: Founder equity, Option pool / SAFEs / notes, Material contracts.

Status: ⚠️ Review Required

4.3 Core Policies & Assets

- Privacy Policy: Not Provided

- Terms of Service: Not Provided

- Limitation of liability: Not confirmed

- Domain ownership: Not Provided (Not Provided)

- DNS verified: No

5. LEGAL RISK & EXPOSURE

5.1 Litigation & Claims

There is no specific evidence of litigation or legal exposure provided in the current

documentation. However, the company's reliance on Delaware jurisdiction for legal disputes

could influence future legal strategies.

Status: ✅ Validated

Page 5

5.2 Regulatory & Tax

- EIN confirmed: 86-7419321

- IRS issue date: March 18, 2024

Seed Interpretation:

Administrative tax issues are flagged unless

persistent or material.

6. SECURITIES & FUNDRAISING HYGIENE

6.1 Prior Fundraising

No securities data extracted.

6.2 Filings & Side Rights

Status: ✅ Validated

Seed Interpretation:

Missing Form D filings are remediable hygiene gaps,

not automatic blockers.

7. RED FLAGS REGISTER (Seed) — WITH EVIDENCE BASIS

| ID |

Category |

Red Flag |

Severity |

Evidence Basis |

| RF-01 |

Evidence Citation Requirement |

No legal evidence documents found |

Medium |

Flagged during validation |

| RF-02 |

Label Integrity Rule |

Legal data coherence low (score: 0/100) |

High |

{'coherence': 0} |

| RF-03 |

Legal Existence Validation |

Legal existence incomplete: entity_exists, legal_name, jurisdiction |

High |

{'entity_exists': False, 'legal_name': False, 'jurisdiction': False} |

| RF-04 |

Good Standing & Qualification |

Good standing status not verified (cleanup item) |

Medium |

Flagged during validation |

| RF-05 |

IP Creation & Assignment |

No IP data provided |

Medium |

Flagged during validation |

| RF-06 |

Capitalization Integrity |

No cap table data provided |

High |

Flagged during validation |

| RF-07 |

Vesting & 83(b) Compliance |

No founder equity data |

Medium |

Flagged during validation |

| RF-08 |

Governance Structure |

Governance structure informal (acceptable for Series A) |

Low |

Flagged during validation |

| RF-09 |

Approvals & Consents |

Missing historical consents (Cleanup Item) |

Medium |

Flagged during validation |

| RF-10 |

Core Policies & Assets |

Core policies not documented (cleanup item) |

Medium |

Flagged during validation |

| RF-11 |

Consistency Checks |

Validation error: 'str' object has no attribute 'get' |

High |

Flagged during validation |

| RF-12 |

Closing vs Cleanup |

Validation error: 'str' object has no attribute 'get' |

High |

Flagged during validation |

| RF-13 |

Legal Red Flag Rule |

Validation error: 'str' object has no attribute 'get' |

High |

Flagged during validation |

8. SEED LEGAL READINESS VERDICT

☐ Cleared to Proceed

☐ Proceed Subject to Cleanup Items

☑ Proceed with Legal

Conditions

☐ Not Cleared (Rare at Seed)

Rationale:

Lunaseed, Inc. requires significant cleanup and validation to

ensure readiness for investment. The combination of incomplete legal documentation, governance

gaps, and potential IP risks necessitates a thorough review before proceeding with funding.

9. APPENDIX — EVIDENCE INDEX (MANDATORY)

| Evidence Category |

Document |

Status |

| Formation |

CERTIFICATE_OF_INCORPORATION.pdf |

Submitted |

| Formation |

INTERNAL_REVENUE_SERVICE.pdf |

Submitted |

| Formation |

BYLAWS.pdf |

Submitted |

END OF REPORT

Page 6